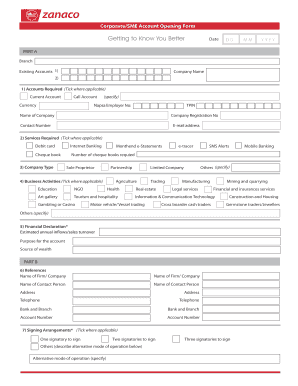

What is SPIN Form-1?

The SPIN Form-1 is for those taxpayers who do not yet have a Taxpayer Identification Number (SPIN). Applicants who have a SPIN can just log onto the official website of Zambia Revenue Authority and fill applications online, as well as fill the other tax forms.

What is the Purpose of SPIN Form-1?

The main purpose of the SPIN Form-1 is initial registration of the taxpayer. It also indicates tax type addition (like PTT, TOT, Medical Levy, IT). Also, the amendment of details, as market in the form, are to be indicated during the filling of the form. This form is created to help taxpayers to register for a SPIN and all tax types from anywhere, on the Zambia Revenue Authority (ERA) official website, without a need to go to a physical ERA office.

When is SPIN Form-1 Due?

All individual applicants engaged in trade or business should FII accomplish and fill and file the application on or before the commencement of business, it shall be finished within thirty (30) calendar days.

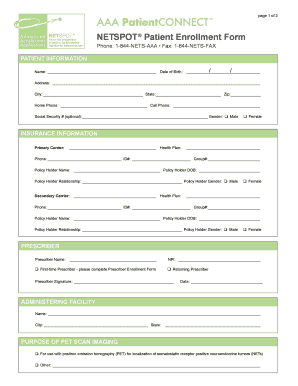

Is SPIN Form-1 Accompanied by Other Documents?

SPIN Form-1 part an is for Tax registration. The applicant should tick the appropriate boxes on the top left of each detail to indicate those items that are being changed. Also, the applicants are not required if amending SPIN registration details. The applicant should complete separate appendixes for Registration details required under VAT, Excise, Mineral Royalty, PAY, Withholding Tax, Presumptive Tax and Base Tax.

What Information do I Provide in SPIN Form-1?

Any applicant, whether natural or juridical, is required under the ERA’s authority of to make, render or file a SPIN Form-1 to be assigned a Taxpayer Identification Number (TIN) to indicate the statement or document to be filed with the Bureau of Internal Revenue, for his proper identification for tax purposes.

Where do I Send SPIN Form-1?

Applicants can also submit the SPIN Form-1 by physically submitting it and any of the supporting documents at ERA’s taxpayer office. In such a case the applicants should quote the acknowledgement number at the front desk. All the applicants can track the status of the application on the official website, using the reference number and search code in the receipt.